tax incentives for electric cars ireland

VRT is paid whenever a car is registered for the first time in Ireland. We have a range of grants available for both new private and new commercial electric vehicles.

A Complete Guide To Ev Ev Charging Incentives In The Uk

VRT relief is up to 5000 for Battery Electric Vehicles BEV.

. Claiming Tax relief on Purchase Price of Electric Vehicle. There are further financial incentives associated with driving an electric vehicle. VAT at 23 is additionally part of the price of all new cars in Ireland.

The grant administered by the Sustainable Energy Authority Of Ireland SEAI was on top of the 5000 tax rebate on Vehicle. Vehicles with an OMSP of greater than 40000 but less than 50000 will receive a reduced level of relief. The exceptions are Tesla and General Motors whose tax credits have been phased out.

The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. Now is the perfect time to purchase with several attractive government incentives in place for those considering an electric vehicle in Ireland. In general terms tax incentives are.

SEAI offer a range of charging grants for private and commercial electric vehicles. 74500 96500 Tax Payable 125. 100000 100000 Proportion of Deductible Vehicle Costs.

President Bidens EV tax credit builds on top of the existing federal EV incentive. Aside from the electric car tax benefits outlined above. A 600 grant is available towards the EV charger.

Government changes tax incentives for electric cars and hybrids. Series production electric motorcycles are exempt from VRT until 31. BEVs up to 5000 till end 2021.

There are also a number of grants available to business owners for purchasing electric company cars and the installation of chargers at the home offers a Government grant of up to 600. The Government has recently invested around 20 million installing a network of high-powered charging points all over the country. Electric Car Servicing Costs A big difference between traditional and electric cars is that electric cars dont need nearly as much servicing as traditional cars.

Choose your make and model today and buy from our dealers list. Will run until December 31st 2022 or up to a maximum of c. Plugin hybrids can get a rebate of up to 2500 while VRT of up to 5000 can be paid back on fully electric cars so youre typically looking at a.

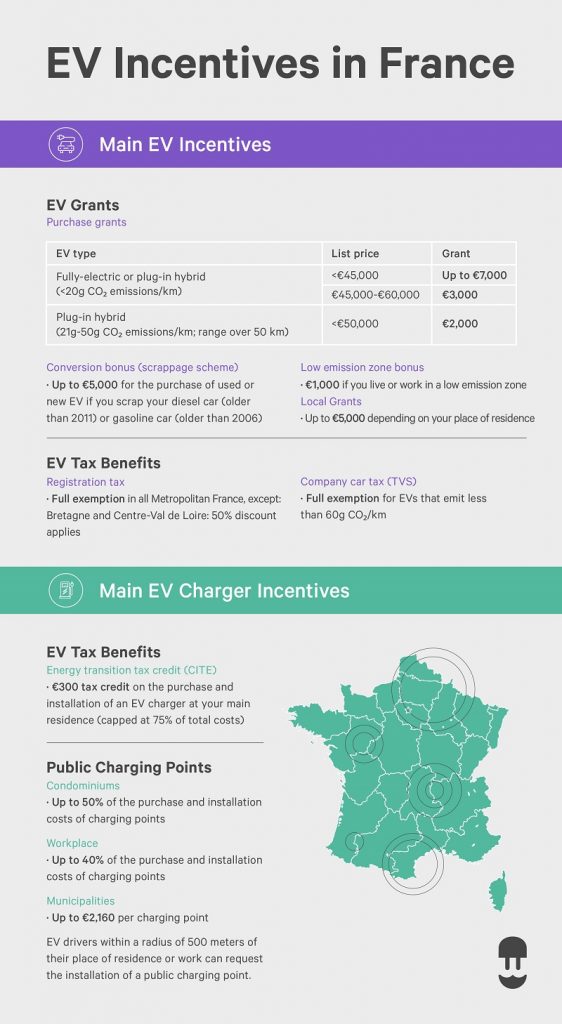

Up to 5000 towards purchase of new battery electric vehicles BEVs. PHEVs with 65g CO2km up to 2500 until the end of 2020. Tax benefits purchase incentives in the European Union July 2020 4 IRELAND Reduction for.

24000 3500 Deductible Charge Point. The incentives include direct subsidies for the acquisition of new electric cars for up to 25 of the purchase price before tax to a maximum of 6000 per vehicle US8600 and 25 of the gross purchase price of other electric vehicles such as buses and vans with a maximum of 15000 or 30000 depending on the range and type of. A hybrid electric vehicle HEV has a battery that can only be recharged while driving.

Electric Vehicles receive VRT relief separately to SEAI grant support. BEVs qualify for the lowest tax band of motor. Normally you write off 125 per annum over 8 years ie 3000 per annum.

0 benefit-in-kind tax rate applies to the value of the car below 50000 effective until 31 Dec 2021. The Motor Tax on a Battery Electric Vehicle in Ireland is the lowest rate possible which is 120 a year. BEV owners pay 50 of the toll rate PHEV 25 of the toll rate.

Other electric car tax benefits. This relief is in place until the end of 2021. EV buyers can currently get a purchase grant of up to 5000 home charging point installation support of 600 relief on vehicle registration tax.

It is typically reflected in the vehicle price displayed by a dealer. Ireland has invested substantially in the electronic vehicle industry. This is one of the steps the Government has been taking to reduce the nations CO2 emissions.

A VRT rebate of up to 5000. 88 100 18 125 Deductible Vehicle Costs. 1500 NA Taxable Profits.

However for passenger vehicles including electric cars this is restricted to 24000. Typically HEVs can drive in battery mode for only a few miles. Our electric vehicle grants make it more affordable to switch to an EV.

This was done to allay peoples fears about not having a charging station. HEVs with 80g CO2km up to 1500 until the end of 2020. Reliefs have been removed for any electric vehicles above 50000.

There is a federal tax credit of up to 7500 available for most electric cars in 2021. Benefits for all Tesla drivers. Low Emissions Vehicle Toll Incentive LEVTI.

Up to 600 to install a home charger unit for new and second-hand BEVs or PHEVs. A purchase grant vehicle registration tax VRT relief a toll incentive a home charger installation grant and reduced motor tax rates. Where a vehicle is purchased through your limited company you may claim tax relief on the cost of the purchase.

Electric Vehicle Toll Incentive EVTI Capped at 500 for private or 1000 a year for commercial LGV SPSV and HDV. Drivers who find themselves requiring access to the London Congestion Charge Zone in an electric vehicle can save 1500 per day. A grant eligibility price cap of 60000 applies.

Electric Vehicle Fossil Fuel Vehicle. All Tesla cars have zero emissions and may be eligible for financial incentives that encourage clean energy use in Ireland. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

Ireland has some of the most generous supports in the world for Electric Vehicle purchase. VRT relief of up to 5000 for BEVs. The tax credit is also.

SEAI Grant of up to 5000 worth 5000 for Electric vehicles 2500 for plug-in hybrids. 9312 12063 Tax Saved. Grants available for electric company cars with a Government incentive of up to 5000 grant per vehicle.

Key Trends and Features of Electric Vehicle Incentive Expenditure. Vehicles with an Open Market Selling Price OMSP of up to 40000 will be granted relief of up to 5000.

Electric Car Grants Ireland Ev Grants Liberty Insurance Ireland

Tax Corner Tax And Electric Vehicles What You Need To Know The Irish News

Will Electric Cars Require Ever More Incentives

How Europe Promotes Electric Vehicles A Brief Insight On Best Practices Transport Turkey

Tax Incentives For Companies Installing Ev Chargers Ev Chargers Ireland Epower

Should I Buy An Electric Car Now In 2022

Electric Vehicles Tax Benefits And Purchase Incentives In The Eu By Country Acea European Automobile Manufacturers Association

Autovista24 Electric Vehicle Tax Guide 2021 The Double Edged Sword Of Ev Incentives

Ireland Halves Phev Subsidies Electrive Com

Government Grants Incentives For Evs In Ireland 2021

How Much Does It Cost To Buy An Electric Car